Accelerating Roof Damage Assessments Using Machine Learning for the Convex Group by Morgan Hill Consultants

In this case, we streamlined the process of assessing roof damage post-natural disasters, delivering a faster and more accurate solution for the Convex Group.

Simplified Underwriting Processes: Significant increase in speed with account ratings happening over 4 times faster than before.

Computational Advancements: Enhanced computational power facilitated quicker access to more extensive and comprehensive information, aiding better decision-making.

Reporting Transformation: Our solution eliminated the need for manual data compilation for year-end and quarterly reports.

Optimised Working Environment: Underwriters benefited from a more connected and efficient workspace enabling them to process more risks swiftly and utilise extensive data for improved decision making.

The client can now upload a large list of addresses and instantly receive a table with pre- and post-event images, along with damage scores.

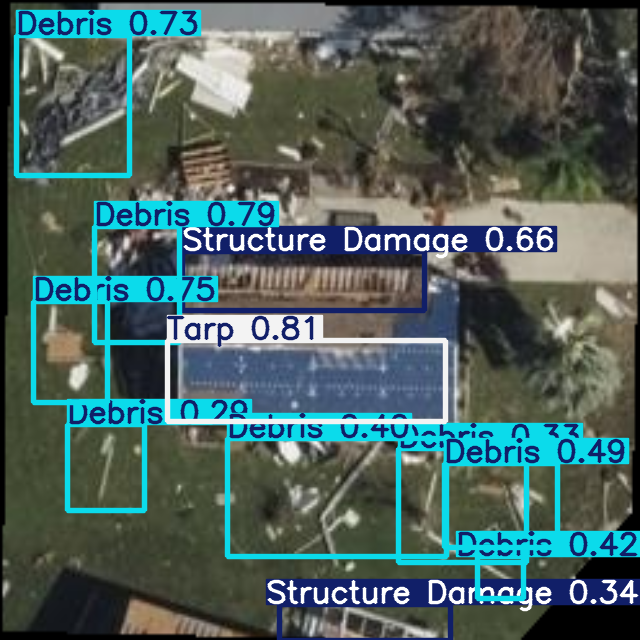

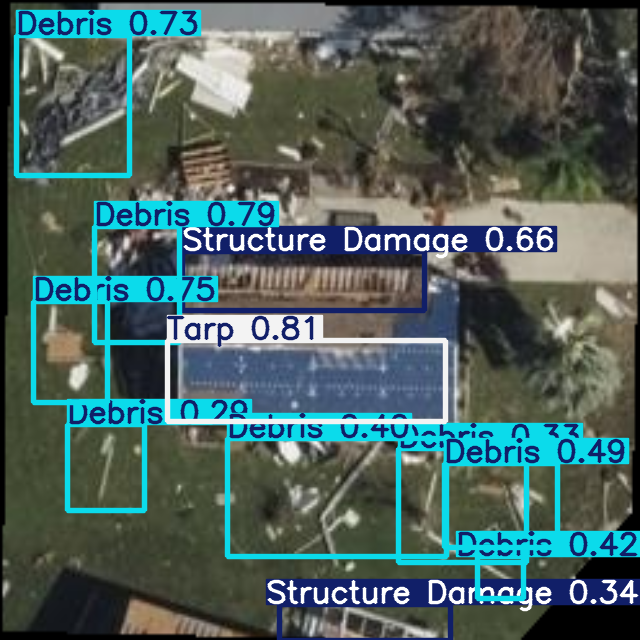

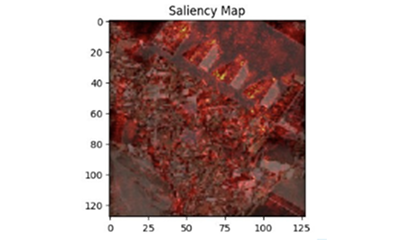

The annotated images provide a clear, visual representation of the damage, supporting faster and more accurate claims decisions.

The process is fully automated, with the client uploading the list of properties of interest, and retrieving the final damage prediction along with supporting images.

Employing Advanced Technological Integration, Morgan Hill transformed the underwriting processes for a major insurance client by streamlining and simplifying their existing systems.

READ MOREMorgan Hill's team of experts enabled a major insurance company to make better decisions and operational efficiencies by delivering a bespoke Machine Learning solution.

READ MOREUsing advanced algorithms and data processing techniques, Morgan Hill identified and optimised cost efficiencies across the IT supply chain of a major UK retail bank.

READ MOREWe offer exploratory workshops to analyse your business landscape, identify key issues, and brainstorm bespoke solutions with our experts and your team.

CONTACT US